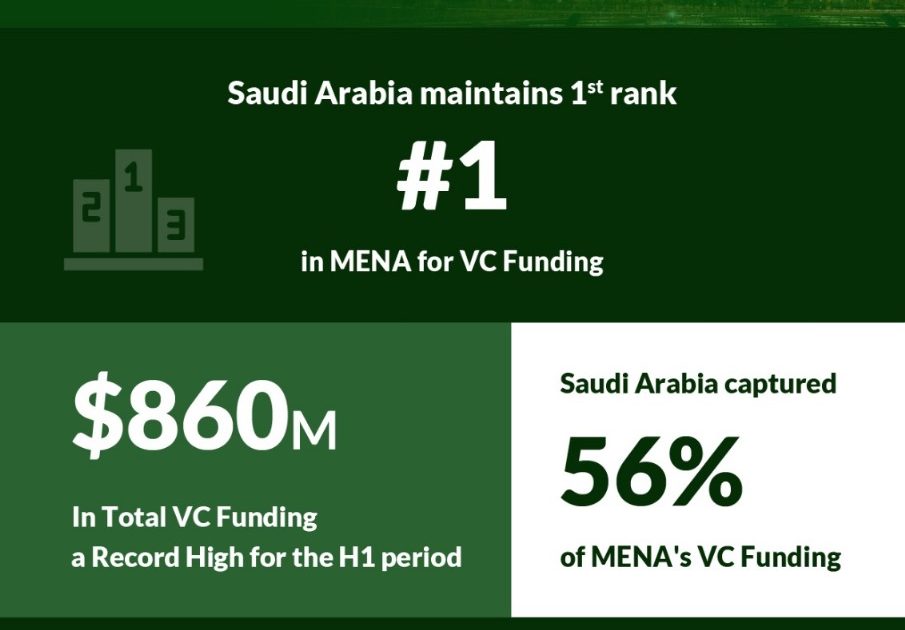

The “H1 2025 MENA Venture Investment Report” revealed that Saudi Arabia maintained its first rank across MENA in terms of Venture Capital (VC) funding in H1 2025, witnessing a total VC deployment of $860 Million (SAR 3.2 billion), surpassing the total VC funding of 2024 (full year). This achievement reflects the development the Kingdom is witnessing in various economic and financial sectors in light of the Saudi Vision 2030 and its goals to strengthen the national economy.

According to the report published today by the venture data platform MAGNiTT, the Kingdom captured the highest share of total VC funding in the MENA region in H1 2025, accounting for 56% of the total capital deployed in the region. The report also revealed that Saudi Arabia achieved a record number of 114 VC deals for the first half of 2025. This confirms the attractiveness of the Saudi market, enhances its competitive environment, and consolidates the strength of the Kingdom’s economy as the largest economy in MENA

Dr. Nabeel Koshak, CEO and Board Member at SVC, commented: “The Kingdom’s leading position in the VC scene in the region comes as a result of many governmental initiatives launched to stimulate the VC and startups ecosystem within the Saudi Vision 2030 programs. We at SVC are committed to continuing to lead the development of the ecosystem by stimulating private investors to provide support for startups and SMEs to be capable of fast and high growth, leading to diversifying the national economy and achieving the goals of the Saudi Vision 2030.”

SVC is an investment company established in 2018. It is a subsidiary of the SME Bank, part of the National Development Fund (NDF). SVC aims to stimulate and sustain financing for Startups and SMEs from pre-Seed to pre-IPO through investment in funds and direct investment in startups and SMEs.